Finance for startups: the basics for not letting your business die

Content

QuickBooks is a good choice for freelancers and small businesses that need a simple way to track expenses, organize receipts and log mileage. Its Elite plan is $120 per organization https://www.bookstime.com/accounting-services-for-startups per month, and includes forecasting and multi-currency handling. For $240 per organization per month, its Ultimate plan includes advanced analytics and 25 custom modules.

- As a new business, you must establish good credit with your vendors from the start.

- Here are the basics of finance needed to build a strong defense – and win the match.

- If you can only hire one person to help you with your financials, we recommend hiring an accountant and getting them to help you set up a bookkeeping system that you can maintain.

- EBITDA is an acronym for Earnings before Interest, Taxes, Depreciation, and Amortization and it is essentially a metric of the best parts of your business’s income statement.

- So we don’t recommend that level of complexity for your seed stage model – just the IS and the cash position (maybe working capital or inventory).

- However, if you’re game, there are times when you should probably handle accounting for your business.

- Melio is another useful accounts payable (AP) software for bookkeeping.

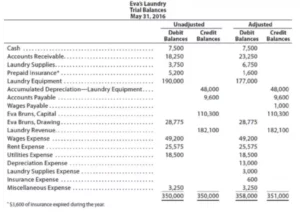

Remember, your bookkeeping system will feed into the work your accountant does. It is messy to procrastinate doing your books until tax season or courting a new investor. The following are tasks you will want for keeping precise books. Before accounting comes into play, you must select a business structure. We recommend talking to an accountant or lawyer to discuss what business entity would be best for your organization. Accounting and bookkeeping services seem similar because they are related.

What is small business accounting?

While accounting may not be the most exciting part of growing your business, it’s crucial to start off on the right foot. Having good management tools from the start is a seriously good idea, check out these European startups that will help you manage your business. An important line item in the income statement is the gross profit figure.

- With Zeni, startups get accurate, GAAP-compliant books and access to finance concierge that is 10x faster than other accounting options thanks to Zeni’s AI-powered processes.

- If you started a business, you will likely want to make money, and it’s very important that you have a system for recording your income and expenses, Christenson said.

- Please see your Brokerage Account Agreement and Synapse’s Terms of Service for further details.

- We’ll provide best practices and illustrate why efficient accounting is vital for your startup.

- In addition to helping you manage your business, a budget and forecast can help you get funding.

- You may be depositing bundles of money in the bank, but this number shows if you’re truly making a profit or just treading water.

These are all sent to its Intelligent Inbox that acts as a single curated transactions feed. Sage 50cloud is a web-based accounting solution designed for SMEs. It is also a great tool for startups for everything accounting, including bookkeeping.

Should you do your accounting in-house or outsource for your startup?

However, most of these things are easy to maintain, and you can partner with a professional accountant to help you organize and optimize your records. The accrual method is more complex than the cash basis method, but it provides a more accurate long-term financial picture of your business. For that reason, it’s useful for providing financial information to investors or making decisions related to business growth and scaling. Bookkeeping is the process of tracking daily transactions and is largely an administrative process. It is not typical for a bookkeeper to conduct any analysis of a company’s finances.

What type of accounting do small businesses use?

Cash basis and accrual basis accounting are the two most popular accounting methods for small business, and in general, you have to use one of these for tax filing purposes. Although it creates more work for you in the long run, it is possible to use different accounting methods for your books and for tax filing.

Once you approve of the categories, transactions automatically settle in your financial statements. Every business owner needs good accounting software to avoid wasting time with manual data entry. Small-business accounting software is something you use to access financial information quickly and easily. It lets you check bank balances, understand revenue and costs, predict profitability, predict tax liabilities, and more. The foundation of solid business bookkeeping is effective and accurate expense tracking.

How to start accounting for a new business

It can be challenging to understand what you can deduct during tax season. An accounting system that maintains and tracks your business finances throughout the year simplifies the process. An experienced accountant can highlight tax deductions you might not know of. A startup accountant London who understands the tax laws will smoothen the company’s paperwork. Transparent and well-managed taxation is one of the most required aspects of accounting for startups. Beyond fundraising and finance, taxation is a crucial area where a startup may face some challenges.

What is the accounting basis for small business?

Cash basis accounting is an accounting system that tracks revenue when businesses receive them. The cash basis method also recognizes expenses only at the time they're paid out. Small business owners and sole proprietors typically use the cash basis method of accounting because of its simplicity.

That really doesn’t reflect reality, because you still need to deliver that service for the rest of the year. With accrual accounting, https://www.bookstime.com/ you would recognize $10,000 of that revenue each month. The remainder would stay on your balance sheet as deferred revenue.

Alert: highest cash back card we’ve seen now has 0% intro APR until nearly 2025

As a business owner, it’s easy to lose perspective and miss things that would be obvious to a trained accountant. They can also help you identify areas where you’re overspending and provide guidance to help you reduce your burn rate. You may want both a checking and a savings account, but at minimum, you should have a checking account to use to pay your expenses and deposit incoming funds.

You might have an unexpected downturn in sales due to uncontrollable external circumstances, or maybe you need a financial boost during slow periods in a seasonal business. Brands with big growth goals often need to secure funding to make investments in new product developments, inventory, retail stores, hiring, and more. You’ll need to determine if you operate your business in an origin-based state or a destination-based state. In the former, you must charge sales tax based on the state where you run your business. The latter requires sales tax to be applied based on the purchaser’s location.

These include automated workflows, project management, recurring transactions, sales approvals, and bank reconciliation. And, the lowest-tiered plan only costs an affordable $20 per organization per month. Other advanced features include modules for inventory management, automatic bank feeds, purchase orders, and exhaustive reports. To determine the best accounting software for small businesses, we reviewed the rates for each and compared the price to its feature set to determine each provider’s value for the price. We also considered the availability of long-term discounts, contract-free plans, money-back guarantees, and whether or not there are any hidden fees or added costs.

- You can also save money by signing up for an annual subscription.

- GAAP is better for running your business, as it helps you match your expenses and revenues with the timing of those activities.

- If startups bring in a ton of cash, this metric will help the business see if their finances are treading water or making a profit.

- Many inexpensive, non-CPA bookkeepers will simply do cash based accounting – which is likely fine for a small coffee shop or ad agency.

- A startup accountant London who understands the tax laws will smoothen the company’s paperwork.

- This app allows you to generate invoices for your clients no matter where you are.