Spread in Forex Trading: Calculation & Strategy

The spread is mostly dictated by liquidity levels – how many people are involved in trading a currency pair. Higher activity in the market means a narrower spread, lower activity means a wider spread. This information has been prepared by IG, a trading name of IG Markets Limited.

In lending, the spread can also refer to the price a borrower pays above a benchmark yield to get a loan. If the prime interest rate is 3%, for example, and a borrower gets a mortgage charging a 5% rate, the spread is 2%. With the business point of view, brokers have to make money against their services. Discover https://g-markets.net/ why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. We also offer an MT4 VPS, which offers low latency and reliable uptime – meaning you’re sure to get fast execution. Our MT4 VPS is hosted by Beeks in London, and it’s the fastest, most reliable VPS on the market.

Traders bet whether the price of the currency pair will be lower than the bid price or higher than the ask price. The narrower the spread, the more attractive the currency pair is because the transaction cost, the cost of entering and exiting a trade, is lower. Spread is usually very small, usually just a few pips, or a fraction of a percentage of the currency unit. However, when making large investments into currency pairs this can quickly add up to significant costs for traders and significant profits for brokers. That is why it is essential to properly calculate spreads before you commit to any type of forex transaction whatsoever.

Forex Spread Betting

In particular, when there is an overlap, such as when the London session is ending and the New York session is beginning, the spread can be narrower still. The spread is also influenced by the general supply and demand of currencies; if there is a high demand for the euro, the value will increase. A good spread starts between zero to five pips, benefitting both the broker and the trader. Terminologies like spread, leverage, pips, market orders, swap fees, and many more all require you to constantly put yourself in a position to learn and evolve your trading techniques. If you’re trading 1 standard lot (equivalent to 100,000 units), the spread cost would be $5 (0.0005 x 100,000). In contrast, others may have wider spreads but provide additional services such as educational resources, research tools, or access to various markets.

Weaker Canadian data reflects in USDCAD FXCM UK – FXCM

Weaker Canadian data reflects in USDCAD FXCM UK.

Posted: Mon, 04 Sep 2023 11:00:21 GMT [source]

Simply put, leverage lets the investor borrow money, usually from the brokerage firm, to place bets on a currency. The investor need only satisfy the margin requirements, which is the capital required to finance the bet, and not the full amount of the entire bet. The spread in forex changes when the difference between the buy and sell price of a currency pair changes. Remember, every forex trade involves buying one currency pair and selling another. The currency on the left is called the base currency, and the one on the right is called the quote currency. When trading FX, the bid price is the cost of buying the base currency, while the ask price is the cost of selling it.

IG services

The spread is typically expressed in pips, which is the smallest unit of price movement in the forex market. Spread trading, like any other form of trading, carries a number of risks that traders and investors should be aware of. For example, market risk can affect the value of the underlying assets and the profitability of the spread trade. Likewise, if you bet that a spread will narrow but it widens, you can lose money.

Therefore, a spread can also be a fee for opening a trade because you “pay” the spread every time you open a trade. It’s important to note that the FX spread can vary over the course of the day, ranging between a ‘high spread’ and a ‘low spread’. As you embark on your forex trading journey, you will need to answer the questions mentioned at the top of this article. There are plenty of brokers out there that have reasonable spreads. Keep in mind, the spread will impact the cost of opening up any forex transaction. The specialist, one of several who facilitates a particular currency trade, may even be in a third city.

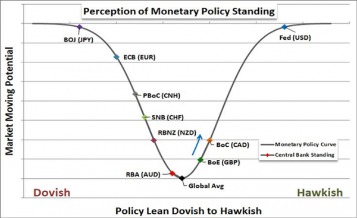

Weekly Forex Report: Analysis and News for January 15-21 2023

The net profit for the investor in this case would be the difference between the two options, or $10 per share. An illustrative example of a spread used in trading is a bull call spread. Spreads can be constructed in any number of ways, and so a trader can use a spread strategy to profit from a bullish, bearish, or sideways market, or if the spread widens vs. narrows. Because of this, spreading is a very flexible tool used by traders. In many securities that feature a two-sided market, such as most stocks, there is a bid-ask spread that appears as the difference between the highest bid price and the lowest offer. Spreads are often priced as a single unit or as pairs on derivatives exchanges to ensure the simultaneous buying and selling of a security.

- If Seattle won by any less than 13 points, or if Denver won the game outright, the bettor would lose their wager.

- Brokerages may also include trading fees in the spread, even if it markets itself as a “commission-free” trading platform.

- The margin on a forex trade is usually only 3.33% of the value of the trade, which means you can make your capital go further while still getting exposure to the full value of the trade.

- It’s important for traders to be familiar with FX spreads as they are the primary cost of trading currencies.

- The spread indicator is usually presented in the form of curve on a graph that shows the direction the spread between the “Ask” and “Bid” prices.

- The spread might normally be one to five pips between the two prices.

Trend following is a simple strategy that can be used when scalping in a 1-minute chart. The goal is to find an asset that is in a bullish trend and then buy it, especially when it makes a pullback. what is spread in forex In this case, you will make some money when the price rises and then move on to the next asset. A bettor would need to wager on Seattle to win by more than 13 points to cover the spread.

Forex trading costs

The bid price is the price at which you can buy the currency, and the ask price is the price at which you can sell it. The above calculations assumed that the daily range is capturable, and this is highly unlikely. Based simply on chance and the average daily range of the EUR/USD, there is far less than a 1% chance of picking the high and low.

Therefore, the ask price determines the price at which the forex broker is willing to sell you the base currency in a given forex pair. Traders look to profit from spreads by betting that the size of the spread will narrow or widen over time. If you buy a spread, you believe that the spread between two prices will widen. For example, if you believe that interest rates on junk bonds will rise faster than that of Treasuries, you can buy that yield spread. This is why the bull call spread is considered a limited risk strategy.

What is Spread in Forex? A Beginner’s Explanation

Sometimes, floating spreads can get very wide due to market fluctuations. Experienced traders can execute a spread trade, opening a Buy and a Sell trade on the same assets with a wide spread, waiting for it to get tighter, and earning on it. A fixed spread is not changing and remains on the same level no matter what happens in the market.

The margin can be as low as 2% of the value of the trade, which means you can make your capital go further while still getting exposure to the full value of the trade. This ultimately will determine the cost you pay to trade foreign currency. The difference between the bid and ask prices—in this instance, 0.0004—is the spread.

Brokers’ Incentives

Spread is one of the most commonly used terms in the world of Forex Trading. Spread is the difference between the Bid (selling price) and the Ask (buying price). The tighter the spread, the sooner the price of the currency pair might move beyond the spread — so you’re more likely to make a gain.